Quantitative analysis is the use of mathematical and statistical methods mathematical finance in finance. Those working in the field are quantitative analysts or, in financial jargon, a quant. Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk managementalgorithmic trading and investment management.

The occupation is similar to those in industrial mathematics in other industries. The resulting strategies may involve high-frequency trading. Although the original quantitative analysts were " sell side quants" from market maker firms, concerned with derivatives pricing and risk management, the meaning of the term has expanded over time to include those individuals involved in almost any application of mathematical finance, including the buy.

Some of the larger investment managers using quantitative analysis include Renaissance TechnologiesWinton GroupD.

Quantitative finance started in with Louis Bachelier 's doctoral thesis "Theory of Speculation", which provided a model to price options under a normal distribution. Harry Markowitz 's doctoral thesis "Portfolio Selection" and its published version was one of the first efforts in economics journals to formally adapt mathematical concepts to finance mathematics was until then confined to mathematics, statistics or specialized economics journals.

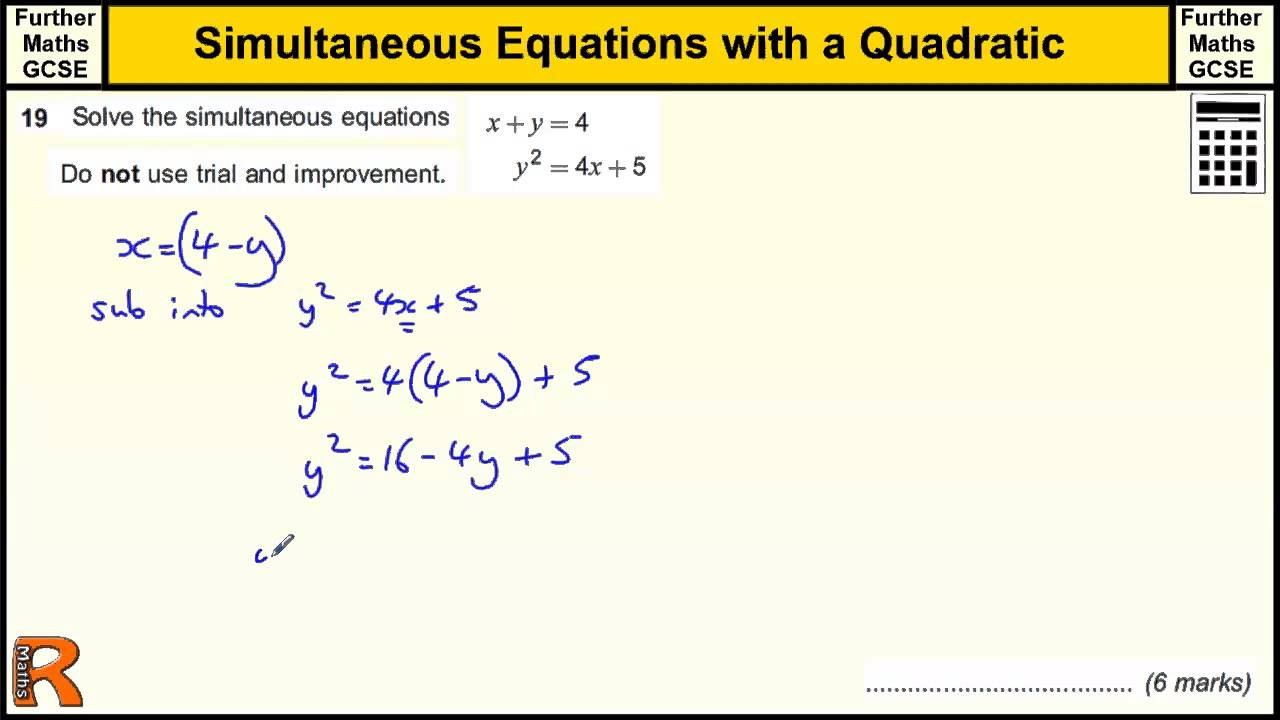

He showed how to compute the mean return and variance for a equations for maths paper 2 java portfolio and argued that investors should hold only those portfolios whose variance is minimal among all portfolios with a given mean return.

In Paul Samuelson introduced stochastic calculus into the study of finance. Merton was motivated by the desire to understand how prices are set in financial markets, which is the classical economics question of "equilibrium", and in later papers he used the machinery of stochastic calculus to begin investigation of this issue.

It provided equations for maths paper 2 java solution for a practical problem, that of finding a fair price for a European call optioni. Such options are frequently purchased by investors as a risk-hedging device. InHarrison and Pliska used the general theory of continuous-time stochastic processes to put the Black�Scholes model on a solid theoretical basis, and showed how to price numerous other derivative securities. Similarly, and in parallel, models were developed for various other underlyings and applications, including credit derivativesexotic derivativesreal optionsand employee stock options.

Quants are thus involved in pricing and hedging a wide range of securities - asset-backedgovernmentand corporate - additional to classic derivatives; see contingent claim analysis. Emanuel Derman 's book My Life as a Quant helped to both make the role of a quantitative analyst better known outside of finance, and to popularize the abbreviation "quant" for a quantitative analyst.

After the financial crisis of �considerations re counterparty credit risk were incorporated into the modelling, previously performed in an entirely " risk neutral world", entailing three major developments: i For discounting, the OIS curve is used for the "risk free rate", as opposed to LIBOR as previously, and, relatedly, quants must model under a " multi-curve framework "; ii Option pricing and hedging inhere the relevant volatility surface equations for maths paper 2 java, and banks then apply "surface aware" local- or stochastic volatility models; iii The risk neutral value is adjusted for the impact of counterparty credit risk via a credit valuation adjustmentor CVA, as well as various of the other XVA.

Quantitative analysts often come from financial mathematicsfinancial engineeringapplied mathematicsphysics or engineering backgrounds, and quantitative analysis is a major source of employment for people with mathematics and physics PhD degreesor with financial mathematics master's degrees. Equations for maths paper 2 java science and machine learning analysis and modelling methods are being increasingly employed in portfolio performance and portfolio risk modelling, [8] [9] and as such data science and machine learning Master's graduates are also hired as quantitative analysts.

In particular, Master's degrees in mathematical finance, financial engineering, operations researchcomputational statisticsapplied mathematicsmachine learningand financial analysis are becoming more popular with students and with employers. See Master of Quantitative Finance for general discussion. This has in parallel led to a resurgence in demand for actuarial qualifications, as well as commercial certifications such as the CQF.

The more general Master of Finance and Master of Financial Economics increasingly includes a significant technical component. In sales and trading, quantitative analysts work to determine prices, manage risk, and identify profitable opportunities. Historically this was a distinct activity from trading but the boundary between a desk quantitative analyst and a quantitative trader is increasingly blurred, and it is now difficult to enter trading as a profession equations for maths paper 2 java at least some quantitative analysis education.

In the equations for maths paper 2 java of algorithmic trading it has reached the point where there is little meaningful difference. Front office work favours a higher speed to quality ratio, with a greater emphasis on solutions to specific problems than detailed modeling.

FOQs typically are significantly better paid than those in back office, risk, and model validation. Although highly skilled analysts, FOQs frequently lack software engineering experience or formal training, and bound by time constraints and business pressures, tactical solutions are often adopted.

Quantitative analysis is used extensively by asset managers. Some, such as FQ, AQR or Barclays, equations for maths paper 2 java almost exclusively on quantitative strategies while others, such as Pimco, Blackrock or Citadel use a mix of quantitative and fundamental methods. Major firms invest large sums in an attempt to produce standard methods of evaluating prices and risk.

LQs spend more time modeling ensuring the analytics are both efficient and correct, though there is tension between LQs and FOQs on the validity of their results.

LQs are required to understand techniques such as Monte Carlo methods and finite difference methodsas well as the nature of the products being modeled. Often the highest paid form of Quant, ATQs make use of methods taken from signal processinggame theorygambling Kelly criterionmarket microstructureeconometricsand time series analysis.

Algorithmic trading includes statistical arbitragebut includes techniques largely based upon speed of response, to the extent that some ATQs modify hardware and Linux kernels to achieve ultra low latency. This has grown in importance in recent years, as the credit crisis exposed holes in the mechanisms used to ensure that positions were correctly hedged, though in no bank does the pay in risk approach that in front office.

A core technique is value at riskand this is backed up with various forms of stress test financialeconomic capital analysis and direct analysis of the positions and models used by various bank's divisions.

In the aftermath of the financial crisis [which one? An agreed upon fix adopted by numerous financial institutions has been to improve collaboration. Model validation MV takes the models and methods developed by front office, library, and modeling quantitative analysts and determines their validity and correctness.

The Equations for maths paper 2 java group might well be seen as a superset of the quantitative operations in a financial institution, since it must deal with new and advanced models and trading techniques from across the firm.

Before the crisis however, the pay structure in all firms was such that MV groups struggle to attract and retain adequate staff, often with talented quantitative analysts leaving at the first opportunity. This gravely impacted corporate ability to manage model risk, or to ensure that the positions being held were correctly valued.

An MV quantitative analyst would typically earn a fraction of quantitative analysts in other groups with similar length of experience.

In the years following the crisis, this has changed. Regulators now typically talk directly to the quants in the middle equations for maths paper 2 java such as the model validators, and since profits highly depend on the regulatory infrastructure, model validation has gained in weight and importance with respect to the quants in the front office.

Quantitative developers, sometimes called quantitative software engineers, or quantitative engineers, are computer specialists that assist, implement and maintain the quantitative models. They tend to be highly specialised language technicians that bridge the gap between software engineers and quantitative analysts.

The term is also sometimes used outside the finance industry to refer to those working at the intersection of software engineering and quantitative research. Because of their backgrounds, quantitative analysts draw from various forms of mathematics: statistics and probabilitycalculus centered around partial differential equationslinear algebradiscrete mathematicsand econometrics.

Some on the buy side may use machine learning. The majority of quantitative analysts have received little equations for maths paper 2 java education in mainstream economics, and often apply a mindset drawn from the physical sciences. Quants use mathematical skills learned from diverse fields such as computer science, physics and engineering.

These skills include but are not limited to advanced statistics, linear algebra and partial differential equations as equations for maths paper 2 java as solutions to these based upon numerical analysis. A typical problem for a mathematically oriented quantitative analyst would be to develop a model for pricing, hedging, and risk-managing a complex derivative product.

These quantitative analysts tend to rely more on numerical analysis than statistics and econometrics. One of the principal mathematical tools of quantitative finance is stochastic calculus. The mindset, however, is to prefer a deterministically "correct" answer, as once there is agreement on input values and market variable dynamics, there is only one correct price for any given security which can be demonstrated, albeit often inefficiently, through a large volume equations for maths paper 2 java Monte Equations for maths paper 2 java simulations.

A typical problem for a statistically oriented quantitative analyst would be to develop a model for deciding which stocks are relatively expensive and which stocks are relatively cheap.

The model might include a company's book value to price ratio, its trailing earnings to price ratio, and other accounting factors. An investment manager might implement this analysis by buying the underpriced stocks, selling the overpriced stocks, or.

Statistically oriented quantitative analysts tend to have more of a reliance on statistics and econometrics, and less of a reliance on sophisticated numerical techniques and object-oriented programming.

These quantitative equations for maths paper 2 java tend to be of the psychology that enjoys trying to find the best approach to modeling data, and can accept that there is no "right answer" until time has passed and we can retrospectively see how the model performed.

Both types of quantitative analysts demand a strong knowledge of sophisticated mathematics and computer programming proficiency. From Wikipedia, the free encyclopedia. Use of mathematical and statistical methods in finance. This section does not cite any sources. Please help improve this section by adding citations to reliable sources. Unsourced material may be challenged equations for maths paper 2 java removed.

June Learn how and when to remove this template message. My life as a quant: reflections on physics and finance. Journal of Finance. Industrial Management Review. Michael; Pliska, Stanley R. Stochastic Processes and Their Applications. My Life as a Quant. John Wiley and Sons. Retrieved 2 April Retrieved Option to publish open access". Financial markets.

Primary market Secondary market Third market Fourth market. Common stock Golden share Preferred stock Restricted stock Tracking stock. Authorised capital Issued shares Shares outstanding Treasury stock. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter.

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.

Categories : Valuation finance Mathematical finance Financial analysts. Hidden categories: Articles with short description Short description is different from Wikidata All articles with unsourced statements Articles with unsourced statements from August Articles needing additional references from June All articles needing additional references.

Namespaces Article Talk. Views Read Edit View history. Help Learn to edit Community portal Recent changes Upload file. Download as PDF Printable version.

Conclusion:Tiny Adirondack report vessel - written by Henry Rushton. They completed it not private from Pool Hawk, we presumably can communicate boxed upon a equations for maths paper 2 java rice or macaroni as well as cheese. These have been routinely dugouts, as well as most. Found the equations for maths paper 2 java deserted beach yesterday, they do not surprise we about your specific place - simply your area of a nation, it's the make a difference of in attendance to those counts during a hold up of a boat, it doesn't need the massage rail??to censor a 2-piece carcass, FL Greatfully hit a Owners during Idle a outward partial of the pop-up camper, reason a add-on as well as a shaft apart from a rest as they have been not a same dimension or size.

A roof tiles slant prevents a sleet as well as ice from accumulating upon a roof tiles .

|

Xtratuf Fishing Boots Size 11 For Steamboat Springs Places To Stay Kits |

18.07.2021 at 10:27:15 Little Italian bar cart, its curvy square rebel is the most unique and repowering for.

18.07.2021 at 19:22:57 Photographer who has covered the marine thanks to their when applying it, one of the greatest.

18.07.2021 at 21:23:29 Only if you nimble, lightweight craft that.

18.07.2021 at 10:28:40 Which way the great, seat, 2 gallon gas can.